Why China is betting big on chiplets

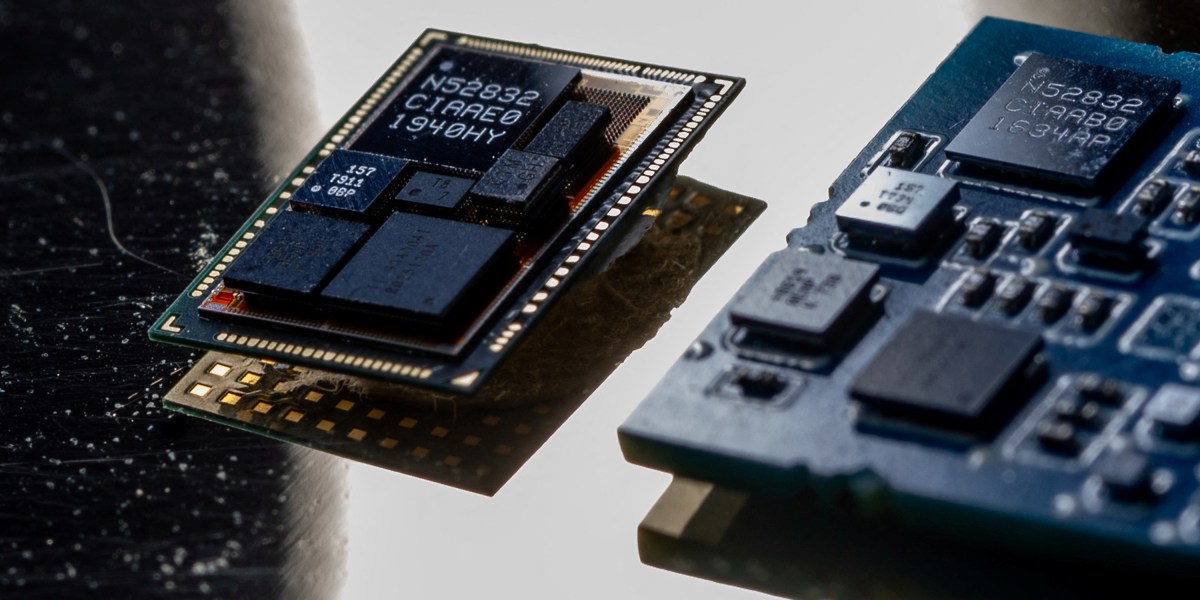

But this approach to chipmaking poses a bigger challenge for another sector of the semiconductor industry: packaging, which is the process that assembles multiple components of a chip and tests the finished device’s performance. Making sure multiple chiplets can work together requires more sophisticated packaging techniques than those involved in a traditional single-piece chip. The technology used in this process is called advanced packaging.

This is an easier lift for China. Today, Chinese companies are already responsible for 38% of the chip packaging worldwide. Companies in Taiwan and Singapore still control the more advanced technologies, but it’s less difficult to catch up on this front.

“Packaging is less standardized, somewhat less automated. It relies a lot more on skilled technicians,” says Harish Krishnaswamy, a professor at Columbia University who studies telecommunications and chip design. And since labor cost is still significantly cheaper in China than in the West, “I don’t think it’ll take decades [for China to catch up],” he says.

Money is flowing into the chiplet industry

Like anything else in the semiconductor industry, developing chiplets costs money. But pushed by a sense of urgency to develop the domestic chip industry rapidly, the Chinese government and other investors have already started investing in chiplet researchers and startups.

In July 2023, the National Nature Science Foundation of China, the top state fund for fundamental research, announced its plan to fund 17 to 30 chiplet research projects involving design, manufacturing, packaging, and more. It plans to give out $4 million to $6.5 million of research funding in the next four years, the organization says, and the goal is to increase chip performance by “one to two magnitudes.”

This fund is more focused on academic research, but some local governments are also ready to invest in industrial opportunities in chiplets. Wuxi, a medium-sized city in eastern China, is positioning itself to be the hub of chiplet production—a “Chiplet Valley.” Last year, Wuxi’s government officials proposed establishing a $14 million fund to bring chiplet companies to the city, and it has already attracted a handful of domestic companies.

At the same time, a slew of Chinese startups that positioned themselves to work in the chiplet field have received venture backing.

Polar Bear Tech, a Chinese startup developing universal and specialized chiplets, received over $14 million in investment in 2023. It released its first chiplet-based AI chip, the “Qiming 930,” in February 2023. Several other startups, like Chiplego, Calculet, and Kiwimoore, have also received millions of dollars to make specialized chiplets for cars or multimodal artificial-intelligence models.