How A.I. and DNA Are Unlocking the Mysteries of Global Supply Chains

At a cotton gin in the San Joaquin Valley, in California, a boxy machine helps to spray a fine mist containing billions of molecules of DNA onto freshly cleaned Pima cotton.

That DNA will act as a kind of minuscule bar code, nestling amid the puffy fibers as they are shuttled to factories in India. There, the cotton will be spun into yarn and woven into bedsheets, before landing on the shelves of Costco stores in the United States. At any time, Costco can test for the DNA’s presence to ensure that its American-grown cotton hasn’t been replaced with cheaper materials — like cotton from the Xinjiang region of China, which is banned in the United States because of its ties to forced labor.

Amid growing concern about opacity and abuses in global supply chains, companies and government officials are increasingly turning to technologies like DNA tracking, artificial intelligence and blockchains to try to trace raw materials from the source to the store.

Companies in the United States are now subject to new rules that require firms to prove their goods are made without forced labor, or face having them seized at the border. U.S. customs officials said in March that they had already detained nearly a billion dollars’ worth of shipments coming into the United States that were suspected of having some ties to Xinjiang. Products from the region have been banned since last June.

Customers are also demanding proof that expensive, high-end products — like conflict-free diamonds, organic cotton, sushi-grade tuna or Manuka honey — are genuine, and produced in ethically and environmentally sustainable ways.

That has forced a new reality on companies that have long relied on a tangle of global factories to source their goods. More than ever before, companies must be able to explain where their products really come from.

The task may seem straightforward, but it can be surprisingly tricky. That’s because the international supply chains that companies have built in recent decades to cut costs and diversify their product offerings have grown astonishingly complex. Since 2000, the value of intermediate goods used to make products that are traded internationally has tripled, driven partly by China’s booming factories.

A large, multinational company may buy parts, materials or services from thousands of suppliers around the world. One of the largest such companies, Procter & Gamble, which owns brands like Tide, Crest and Pampers, has nearly 50,000 direct suppliers. Each of those suppliers may, in turn, rely on hundreds of other companies for the parts used to make its product — and so on, for many levels up the supply chain.

A New Generation of Chatbots

A brave new world. A new crop of chatbots powered by artificial intelligence has ignited a scramble to determine whether the technology could upend the economics of the internet, turning today’s powerhouses into has-beens and creating the industry’s next giants. Here are the bots to know:

To make a pair of jeans, for example, various companies must farm and clean cotton, spin it into thread, dye it, weave it into fabric, cut the fabric into patterns and stitch the jeans together. Other webs of companies mine, smelt or process the brass, nickel or aluminum that is crafted into the zipper, or make the chemicals that are used to manufacture synthetic indigo dye.

“Supply chains are like a bowl of spaghetti,” said James McGregor, the chairman of the greater China region for APCO Worldwide, an advisory firm. “They get mixed all over. You don’t know where that stuff comes from.”

Given these challenges, some companies are turning to alternative methods, not all proven, to try to inspect their supply chains.

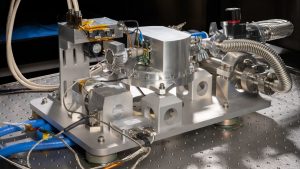

Some companies — like the one that sprays the DNA mist onto cotton, Applied DNA Sciences — are using scientific processes to tag or test a physical attribute of the good itself, to figure out where it has traveled on its path from factories to consumer.

Applied DNA has used its synthetic DNA tags, each just a billionth of the size of a grain of sugar, to track microcircuits produced for the Department of Defense, trace cannabis supply chains to ensure the product’s purity and even to mist robbers in Sweden who attempted to steal cash from A.T.M.s, leading to multiple arrests.

MeiLin Wan, the vice president for textiles at Applied DNA, said the new regulations were creating a “tipping point for real transparency.”

“There definitely is a lot more interest,” she added.

The cotton industry was one of the earliest adopters of tracing technologies, in part because of previous transgressions. In the mid-2010s, Target, Walmart and Bed Bath & Beyond faced expensive product recalls or lawsuits after the “Egyptian cotton” sheets they sold turned out to have been made with cotton from elsewhere. A New York Times investigation last year documented that the “organic cotton” industry was also rife with fraud.

In addition to the DNA mist it applies as a marker, Applied DNA can figure out where cotton comes from by sequencing the DNA of the cotton itself, or analyzing its isotopes, which are variations in the carbon, oxygen and hydrogen atoms in the cotton. Differences in rainfall, latitude, temperature and soil conditions mean these atoms vary slightly across regions of the world, allowing researchers to map where the cotton in a pair of socks or bath towel has come from.

Other companies are turning to digital technology to map supply chains, by creating and analyzing complex databases of corporate ownership and trade.

Some firms, for example, are using blockchain technology to create a digital token for every product that a factory produces. As that product — a can of caviar, say, or a batch of coffee — moves through the supply chain, its digital twin gets encoded with information about how it has been transported and processed, providing a transparent log for companies and consumers.

Other companies are using databases or artificial intelligence to comb through vast supplier networks for distant links to banned entities, or to detect unusual trade patterns that indicate fraud — investigations that could take years to carry out without computing power.

Sayari, a corporate risk intelligence provider that has developed a platform combining data from billions of public records issued globally, is one of those companies. The service is now used by U.S. customs agents as well as private companies. On a recent Tuesday, Jessica Abell, the vice president of solutions at Sayari, ran the supplier list of a major U.S. retailer through the platform and watched as dozens of tiny red flags appeared next to the names of distant companies.

“We’re flagging not only the Chinese companies that are in Xinjiang, but then we’re also automatically exploring their commercial networks and flagging the companies that are directly connected to it,” Ms. Abell said. It is up to the companies to decide what, if anything, to do about their exposure.

Studies have found that most companies have surprisingly little visibility into the upper reaches of their supply chains, because they lack either the resources or the incentives to investigate. In a 2022 survey by McKinsey & Company, 45 percent of respondents said they had no visibility at all into their supply chain beyond their immediate suppliers.

But staying in the dark is no longer feasible for companies, particularly those in the United States, after the congressionally imposed ban on importing products from Xinjiang — where 100,000 ethnic minorities are presumed by the U.S. government to be working in conditions of forced labor — went into effect last year.

Xinjiang’s links to certain products are already well known. Experts have estimated that roughly one in five cotton garments sold globally contains cotton or yarn from Xinjiang. The region is also responsible for more than 40 percent of the world’s polysilicon, which is used in solar panels, and a quarter of its tomato paste.

But other industries, like cars, vinyl flooring and aluminum, also appear to have connections to suppliers in the region and are coming under more scrutiny from regulators.

Having a full picture of their supply chains can offer companies other benefits, like helping them recall faulty products or reduce costs. The information is increasingly needed to estimate how much carbon dioxide is actually emitted in the production of a good, or to satisfy other government rules that require products to be sourced from particular places — such as the Biden administration’s new rules on electric vehicle tax credits.

Executives at these technology companies say they envision a future, perhaps within the next decade, in which most supply chains are fully traceable, an outgrowth of both tougher government regulations and the wider adoption of technologies.

“It’s eminently doable,” said Leonardo Bonanni, the chief executive of Sourcemap, which has helped companies like the chocolate maker Mars map out their supply chains. “If you want access to the U.S. market for your goods, it’s a small price to pay, frankly.”

Others express skepticism about the limitations of these technologies, including their cost. While Applied DNA’s technology, for example, adds only 5 to 7 cents to the price of a finished piece of apparel, that may be significant for retailers competing on thin margins.

And some express concerns about accuracy, including, for example, databases that may flag companies incorrectly. Investigators still need to be on the ground locally, they say, speaking with workers and remaining alert for signs of forced or child labor that may not show up in digital records.

Justin Dillon, the chief executive of FRDM, a software company that helps organizations map their supply chains, said there was “a lot of angst, a lot of confusion” among companies trying to satisfy the government’s new requirements.

Importers are “looking for boxes to check,” he said. “And transparency in supply chains is as much an art as it is a science. It’s kind of never done.”