Eurozone inflation hits record high of 9.1%

Inflation in the eurozone hit its highest ever level this month, pushed up to 9.1% by soaring energy costs exacerbated by the war in Ukraine.It is the ninth consecutive month to set a record rate for inflation in Europe, with consumer prices rising steadily since November 2021.

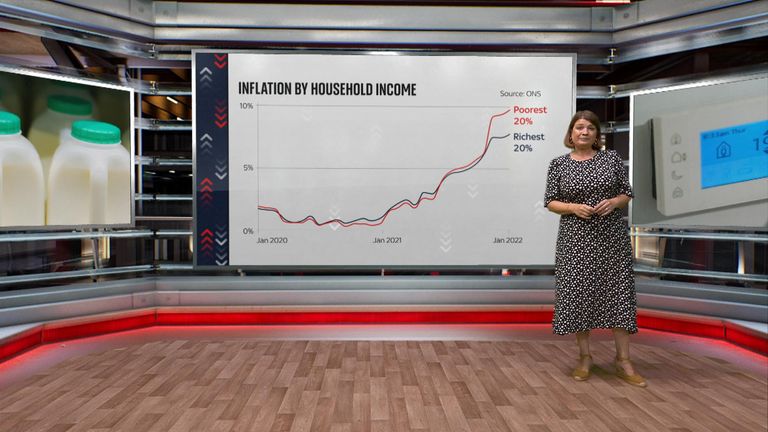

The UK currently has the worst inflation of all the G7 countries, hitting 10.1% in the 12 months to July.Energy was the main instigator of Europe’s surging inflation, topping an annual inflation rate of 38.3%, according to Eurostat, the statistics authority.Food, alcohol and tobacco also rose to 10.6%, compared to 9.8% in July.

Within the EU, some countries have already blown past the bloc’s headline inflation rate.Estonia – one of the poorer countries in the union – has the eurozone’s highest inflation rate at 25.2%, followed by Lithuania at 21.1% and Latvia at 20.8%.

More from Business

Economists at investment bank Goldman Sachs warned on Tuesday that the UK’s inflation could exceed 22% next year if gas prices are not driven down.”In a scenario where gas prices remain elevated at current levels, we would expect the price cap to increase by over 80% in January (vs 19% assumed in our baseline),” they said in a research note.

Advertisement

“(This) would imply headline inflation peaking at 22.4%, well above our baseline forecast of 14.8%.”

Please use Chrome browser for a more accessible video player

2:16

What is driving the inflation spike?

Last week economists from Citi said consumer price inflation was set to peak at 18.6% in January, more than nine times the Bank of England’s target.Goldman said it expected a recession to begin in the fourth quarter, with the economy set to contract by 0.6% in 2023 as a whole.Spain, meanwhile, reported that inflation had potentially started to slow down, falling from 10.7% in July to 10.3% in August.In July, the euro currency fell to below parity against the dollar for the first time in nearly 20 years.A couple of weeks later, the European Central Bank (ECB) hiked interest rates for the first time in 11 years.The bank raised its main policy rate by 50 basis points, surprising some economists – and is expected to hike it again on 8 September.

Inflation in the eurozone hit its highest ever level this month, pushed up to 9.1% by soaring energy costs exacerbated by the war in Ukraine.

It is the ninth consecutive month to set a record rate for inflation in Europe, with consumer prices rising steadily since November 2021.

The UK currently has the worst inflation of all the G7 countries, hitting 10.1% in the 12 months to July.

Energy was the main instigator of Europe’s surging inflation, topping an annual inflation rate of 38.3%, according to Eurostat, the statistics authority.

Food, alcohol and tobacco also rose to 10.6%, compared to 9.8% in July.

Within the EU, some countries have already blown past the bloc’s headline inflation rate.

Estonia – one of the poorer countries in the union – has the eurozone’s highest inflation rate at 25.2%, followed by Lithuania at 21.1% and Latvia at 20.8%.

Economists at investment bank Goldman Sachs warned on Tuesday that the UK’s inflation could exceed 22% next year if gas prices are not driven down.

“In a scenario where gas prices remain elevated at current levels, we would expect the price cap to increase by over 80% in January (vs 19% assumed in our baseline),” they said in a research note.

“(This) would imply headline inflation peaking at 22.4%, well above our baseline forecast of 14.8%.”

Last week economists from Citi said consumer price inflation was set to peak at 18.6% in January, more than nine times the Bank of England’s target.

Goldman said it expected a recession to begin in the fourth quarter, with the economy set to contract by 0.6% in 2023 as a whole.

Spain, meanwhile, reported that inflation had potentially started to slow down, falling from 10.7% in July to 10.3% in August.

In July, the euro currency fell to below parity against the dollar for the first time in nearly 20 years.

A couple of weeks later, the European Central Bank (ECB) hiked interest rates for the first time in 11 years.

The bank raised its main policy rate by 50 basis points, surprising some economists – and is expected to hike it again on 8 September.