FirstFT: Biden’s student debt relief plan triggers inflation warnings

Good morning and we start today with Joe Biden’s long-awaited student debt relief proposal.The US president yesterday said that the government would cancel $10,000 of repayments for anyone earning less than $125,000. Those in receipt of Pell grants, which are given to those in particular financial need, will qualify for $20,000 worth of debt to be cancelled.A moratorium on all payments, which has been in place since the start of the coronavirus pandemic, will be extended until the end of the year.According to the White House, 43mn borrowers will have their payments reduced, and 20mn of those will have their balance wiped out entirely.The Federal Reserve Bank of New York estimates that US student debt stood at $1.6tn in the second quarter — $700bn more than Americans owe on their credit cards.Democrats on the left of the party have long argued that cancelling student debt is progressive, given that the financial burden falls more heavily on lower-income households. But opponents of the policy argue it risks stoking inflation, which is already at a 40-year high. Marc Goldwein, senior policy director at the hawkish Committee for a Responsible Federal Budget, has calculated that the proposal would almost eliminate the deflationary impact of the recently passed Inflation Reduction Act.Jason Furman, who was chair of Barack Obama’s council of economic advisers, said in a tweet after the announcement: “Pouring roughly half [a] trillion dollars of gasoline on the inflationary fire that is already burning is reckless.”What do you think? Is Joe Biden’s policy inflationary or is it a move you welcome? Email firstft@ft.com or hit reply on this email and your answer may feature in a future edition of FirstFT. Our colleagues on the FT’s News Briefing podcast want to hear from you if you are paying off a student loan. Record and submit your message.Further reading: US financial editor Gary Silverman wrote earlier this month on the quandary facing the White House over student debt. Lex wrote about the soaring costs of US education in June. Thanks for reading FirstFT Europe/Africa — GaryFive more stories in the news1. Wall Street seeks ways to skirt Biden’s share buyback tax Bankers and lawyers on Wall Street are hunting for ways to help companies buy back shares next year without having to pay millions of dollars in extra tax. The plans hinge on forthcoming Treasury guidance surrounding a programme known as accelerated share repurchases.2. Texas accuses BlackRock of energy company ‘boycott’ in ESG clampdown Texas has escalated its campaign against environmental, social and governance investing by accusing BlackRock and nine listed European financial groups of boycotting the fossil fuel industry. The resolution could lead state pension funds with billions of dollars under management to divest shares held in the financial groups.3. Biden administration wins legal challenge to Idaho abortion ban The Biden administration has won a legal victory in its battle to protect women’s reproductive rights as a judge in Idaho stopped the state from implementing a ban on abortions in cases in which the mother’s life is at risk.4. Hedge funds build biggest bet against Italian debt since 2008 Hedge funds have lined up their biggest bets against Italian government bonds since the global financial crisis on concerns over political turmoil in Rome and the country’s dependence on Russian gas imports.5. Blackstone seeks Pink Floyd catalogue The US private equity group is vying to buy Pink Floyd’s back catalogue, a big bet on music rights that could value the psychedelic rock band’s songs at almost half a billion dollars. Artists including Bruce Springsteen and Bob Dylan have sold their songbooks for hundreds of millions of dollars in recent years.The day aheadJackson Hole Economic Symposium The annual conference of central bankers, sponsored by the Federal Reserve Bank of Kansas City, begins in Wyoming today. The highlight of the symposium will be Federal Reserve chair Jay Powell’s speech tomorrow. US economics editor Colby Smith has a preview while our data visualisation team have created this simple guide to the challenge facing the Fed as it battles four-decade-high inflation. Economic data Preliminary figures for US economic growth in the second quarter are expected to show the decline in gross domestic product was less severe than previously estimated. Economists polled by Refinitiv expect the US economy to have shrunk 0.8 per cent during the three months to June 30, a slight improvement on the 0.9 per cent contraction reported in the advance figure.Company earnings Peloton, the connected fitness company, is expected to have continued to struggle in the fourth quarter, following a drop in demand for its popular stationary bike as more people return to in-person workouts. Discount retailers Dollar General and Dollar Tree are expected to show they are reaping the benefits of the inflationary environment when they release results. Also reporting are Burlington Stores and Abercrombie & Fitch before the bell, while computer company Dell, retailer Gap and beauty company Ulta announce earnings this afternoon. California to pass zero-emission car rule California is poised to enact rules that halt sales of new petrol-powered vehicles by 2035 as the US state that has been a bellwether on environmental policy takes aim at its largest source of carbon emissions.What else we’re reading The battle to keep an American state The IRS-as-globalist-autocracy is only one of many disinformation campaigns directed at Biden by his Republican opponents, argues Edward Luce. Financing the US government is about to get much costlier, he says, and Biden’s Inflation Reduction Act will go some way towards levelling the playing field between underpaid IRS agents and overpaid corporate lawyers.

© Ellie Foreman-Peck

Booming cocaine trade now stains most of Latin America After five decades of the US-led war on drugs and billions of dollars spent on interdiction and the pursuit of cartel bosses, the Latin American drugs trade has never been larger. The policy failure is leading an increasing number of South American politicians to call for the legalisation of cocaine, says Latin America editor Michael Stott.Big budget blockbusters land amid ‘peak TV’ fears Audiences can enjoy some of the most expensive programmes ever produced this autumn, from Amazon Prime’s The Rings of Power to HBO Max’s House of the Dragon. But the shows are being served at subsidised prices by streaming platforms making record losses, begging the question: have we finally reached “peak TV”? The budget drone changing global warfare The sleek Bayraktar TB2 is fast, cheap — with a seven-figure price tag — and deadly. Ukraine’s drone of choice has made Turkey one of the world’s top drone powers, pointing to a new era in which the technology becomes accessible to regimes that cannot buy from more established arms producers.Buckle up. We’ve hit peak Human-Autonomy Clash We are in an era in which the unpredictability of people meets the as-yet not fully capable autonomous car. In this moment, which San Francisco correspondent Dave Lee calls the “Human-Autonomy Clash”, there will be crashes, and there will be anger. Reader pollThis week, a group of Apple workers launched a petition as part of efforts to resist an order from chief executive Tim Cook to return to the office. Other Silicon Valley companies are more relaxed. Facebook’s owner Meta has embraced virtual working as a permanent alternative while Dropbox has declared itself a “Virtual First” company. Do you think staff should be forced back to the office? Vote in our latest poll.

Good morning and we start today with Joe Biden’s long-awaited student debt relief proposal.

The US president yesterday said that the government would cancel $10,000 of repayments for anyone earning less than $125,000. Those in receipt of Pell grants, which are given to those in particular financial need, will qualify for $20,000 worth of debt to be cancelled.

A moratorium on all payments, which has been in place since the start of the coronavirus pandemic, will be extended until the end of the year.

According to the White House, 43mn borrowers will have their payments reduced, and 20mn of those will have their balance wiped out entirely.

The Federal Reserve Bank of New York estimates that US student debt stood at $1.6tn in the second quarter — $700bn more than Americans owe on their credit cards.

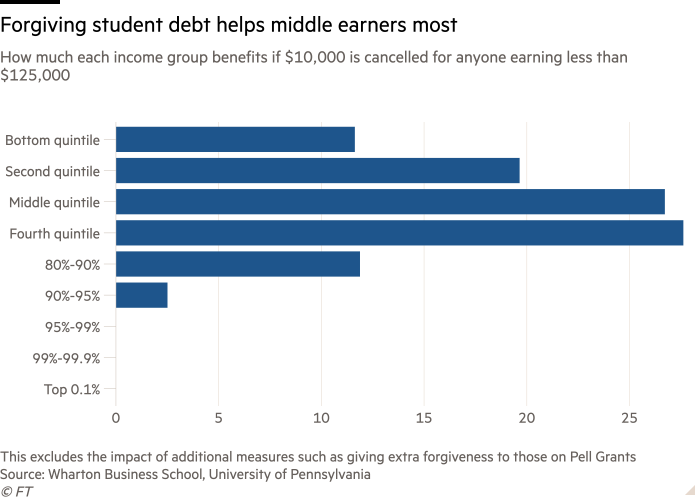

Democrats on the left of the party have long argued that cancelling student debt is progressive, given that the financial burden falls more heavily on lower-income households.

But opponents of the policy argue it risks stoking inflation, which is already at a 40-year high.

Marc Goldwein, senior policy director at the hawkish Committee for a Responsible Federal Budget, has calculated that the proposal would almost eliminate the deflationary impact of the recently passed Inflation Reduction Act.

Jason Furman, who was chair of Barack Obama’s council of economic advisers, said in a tweet after the announcement: “Pouring roughly half [a] trillion dollars of gasoline on the inflationary fire that is already burning is reckless.”

What do you think? Is Joe Biden’s policy inflationary or is it a move you welcome? Email firstft@ft.com or hit reply on this email and your answer may feature in a future edition of FirstFT. Our colleagues on the FT’s News Briefing podcast want to hear from you if you are paying off a student loan. Record and submit your message.

-

Further reading: US financial editor Gary Silverman wrote earlier this month on the quandary facing the White House over student debt. Lex wrote about the soaring costs of US education in June.

Thanks for reading FirstFT Europe/Africa — Gary

Five more stories in the news

1. Wall Street seeks ways to skirt Biden’s share buyback tax Bankers and lawyers on Wall Street are hunting for ways to help companies buy back shares next year without having to pay millions of dollars in extra tax. The plans hinge on forthcoming Treasury guidance surrounding a programme known as accelerated share repurchases.

2. Texas accuses BlackRock of energy company ‘boycott’ in ESG clampdown Texas has escalated its campaign against environmental, social and governance investing by accusing BlackRock and nine listed European financial groups of boycotting the fossil fuel industry. The resolution could lead state pension funds with billions of dollars under management to divest shares held in the financial groups.

3. Biden administration wins legal challenge to Idaho abortion ban The Biden administration has won a legal victory in its battle to protect women’s reproductive rights as a judge in Idaho stopped the state from implementing a ban on abortions in cases in which the mother’s life is at risk.

4. Hedge funds build biggest bet against Italian debt since 2008 Hedge funds have lined up their biggest bets against Italian government bonds since the global financial crisis on concerns over political turmoil in Rome and the country’s dependence on Russian gas imports.

5. Blackstone seeks Pink Floyd catalogue The US private equity group is vying to buy Pink Floyd’s back catalogue, a big bet on music rights that could value the psychedelic rock band’s songs at almost half a billion dollars. Artists including Bruce Springsteen and Bob Dylan have sold their songbooks for hundreds of millions of dollars in recent years.

The day ahead

Jackson Hole Economic Symposium The annual conference of central bankers, sponsored by the Federal Reserve Bank of Kansas City, begins in Wyoming today. The highlight of the symposium will be Federal Reserve chair Jay Powell’s speech tomorrow. US economics editor Colby Smith has a preview while our data visualisation team have created this simple guide to the challenge facing the Fed as it battles four-decade-high inflation.

Economic data Preliminary figures for US economic growth in the second quarter are expected to show the decline in gross domestic product was less severe than previously estimated. Economists polled by Refinitiv expect the US economy to have shrunk 0.8 per cent during the three months to June 30, a slight improvement on the 0.9 per cent contraction reported in the advance figure.

Company earnings Peloton, the connected fitness company, is expected to have continued to struggle in the fourth quarter, following a drop in demand for its popular stationary bike as more people return to in-person workouts. Discount retailers Dollar General and Dollar Tree are expected to show they are reaping the benefits of the inflationary environment when they release results. Also reporting are Burlington Stores and Abercrombie & Fitch before the bell, while computer company Dell, retailer Gap and beauty company Ulta announce earnings this afternoon.

California to pass zero-emission car rule California is poised to enact rules that halt sales of new petrol-powered vehicles by 2035 as the US state that has been a bellwether on environmental policy takes aim at its largest source of carbon emissions.

What else we’re reading

The battle to keep an American state The IRS-as-globalist-autocracy is only one of many disinformation campaigns directed at Biden by his Republican opponents, argues Edward Luce. Financing the US government is about to get much costlier, he says, and Biden’s Inflation Reduction Act will go some way towards levelling the playing field between underpaid IRS agents and overpaid corporate lawyers.

Booming cocaine trade now stains most of Latin America After five decades of the US-led war on drugs and billions of dollars spent on interdiction and the pursuit of cartel bosses, the Latin American drugs trade has never been larger. The policy failure is leading an increasing number of South American politicians to call for the legalisation of cocaine, says Latin America editor Michael Stott.

Big budget blockbusters land amid ‘peak TV’ fears Audiences can enjoy some of the most expensive programmes ever produced this autumn, from Amazon Prime’s The Rings of Power to HBO Max’s House of the Dragon. But the shows are being served at subsidised prices by streaming platforms making record losses, begging the question: have we finally reached “peak TV”?

The budget drone changing global warfare The sleek Bayraktar TB2 is fast, cheap — with a seven-figure price tag — and deadly. Ukraine’s drone of choice has made Turkey one of the world’s top drone powers, pointing to a new era in which the technology becomes accessible to regimes that cannot buy from more established arms producers.

Buckle up. We’ve hit peak Human-Autonomy Clash We are in an era in which the unpredictability of people meets the as-yet not fully capable autonomous car. In this moment, which San Francisco correspondent Dave Lee calls the “Human-Autonomy Clash”, there will be crashes, and there will be anger.

Reader poll

This week, a group of Apple workers launched a petition as part of efforts to resist an order from chief executive Tim Cook to return to the office. Other Silicon Valley companies are more relaxed. Facebook’s owner Meta has embraced virtual working as a permanent alternative while Dropbox has declared itself a “Virtual First” company. Do you think staff should be forced back to the office? Vote in our latest poll.