China’s power crunch and why SoftBank cut back on Alibaba

Hello, this is Kenji from Hong Kong, where we are in the midst of the mid-year earnings season. The overall tone so far seems to be tilting toward the negative side, and the tech sector is no exception. While JD.com pleasantly surprised the market with its results, both Tencent Holdings and Alibaba Group Holding reported zero top line growth for the first time since their listings over a decade ago. Smartphone maker Xiaomi saw its net profit for the first half of the year dip 95 per cent, while component makers such as Sunny Optical and AAC saw their bottom lines cut by half or more.The weak results are a function of various factors, primarily Covid-19 lockdowns, rising input costs, a tight regulatory regime for the tech sector and heightened geopolitical tensions — all which have combined to decelerate the Chinese economy as a whole.And now, a new downward push is coming from the inland province of Sichuan, perhaps more familiar in its traditional spelling of “Szechwan,” from its connection with the local spicy cuisine. A severe power shortage in the area is forcing factories to shut down, snarling supply chains for everything from automobiles to Apple products. It is not clear how long the situation will drag on, but it has already brought another aspect of supply chain vulnerability to light.Crunch timeThe latest woe to hit China’s supply chain comes from the sizzling sunshine in the southwestern landlocked province of Sichuan and its neighbour Chongqing. In a series of reports, Nikkei’s Shunsuke Tabeta reveals how the historic drought has dried up the hydro-dams and derailed production of Tesla, Toyota Motor, Foxconn and more.With rainfall dropping to half its normal level and temperatures regularly rising above 40C, hydroelectric power output — which accounts for nearly 80 per cent of the province’s generating capacity — has been drastically curtailed. The local government originally ordered industrial companies to halt production for the week through August 20, but that was extended multiple times, until Sunday for Sichuan and indefinitely for Chongqing. A total of 16,000 companies had to comply with the production suspension, hitting supply chains for a range of sectors.The power supply squeeze in Sichuan also forced Shanghai’s historic riverfront Bund district to switch off its night-time lights for two days this week. The city’s earlier request to the province to prioritise resumption of suppliers providing parts for Tesla and SAIC Motor drew a backlash from ordinary people whose lives are also being affected by the shortages.SoftBank explains itselfSoftBank Group has sold a large part of its stake in Alibaba to reassure investors that its finances were solid after logging a record quarterly loss of $23bn, Kana Inagaki and Leo Lewis write for the Financial Times.In an exclusive interview, Yoshimitsu Goto, its chief financial officer, dismissed market concerns that continued heavy losses at the technology conglomerate could strain its relationship with lenders.“In times like this, it is critical as an investment group to instantly show that our financial strength is rock solid,” Goto said.According to Goto, the move was designed to mirror the previous sale of some of SoftBank’s most prized holdings that began when the Covid-19 pandemic led to a crash in its share price in March 2020.Although the sale helped to shore up the company’s balance sheet, the decision to sharply reduce the Alibaba stake also comes with the political risk of being seen to abandon a Chinese investment at a sensitive time. China is in the throes of a regulatory crackdown on tech companies and diplomatic relations between Beijing and Tokyo are strained.Wingtech takes flightWingtech Technology has been an Apple supplier for less than a year. But to many industry insiders, its rise has been surprisingly fast, according to a report by Shunsuke Tabeta and Nikkei Asia’s Cheng Ting-Fang and Lauly Li. Revenue and profit growth are a testament to the success of its ambitions to far.The Chinese smartphone assembler already makes the Mac Mini desktop computer, and has recently won orders to build an older generation of MacBooks. Apple’s laptops are considered the most advanced consumer notebooks available, and their production has long been dominated by top Taiwanese contractors Quanta Computer and Foxconn. The Shanghai-listed challenger is now planning to hire at least 20,000 additional workers for its factory in Yunnan Province, the base from which it aims to capture more of the Apple and Samsung supply chain.Robotic rumbleThe race for hegemony in robotics is heating up as players from China, South Korea and Japan scramble for a slice of one of the most promising tech markets.At the World Robot Conference 2022 held in Beijing, Nikkei Asia’s CK Tan got an up-close look at the 130 Chinese and foreign exhibitors showing off their latest wares, from drones to humanoid bots. Homegrown robot makers, he found, are increasingly eyeing the service and healthcare sectors as technology levels and labour costs both rise.These are precisely the areas that rivals are looking at. In South Korea, the use of robots in the logistics and restaurant industries is already expanding to cope with serious labour shortages and a rising minimum wage. Japanese player Medicaroid, meanwhile, is preparing to venture beyond its home market to sell its surgical robots elsewhere in Asia.Suggested readsChipmakers caught in crossfire of rising US-China geopolitical tensions (FT)The mystery of SoftBank’s zero tax bill (Nikkei Asia)Fujitsu, Riken to offer 1st Japan-made quantum computer (Nikkei Asia)Hyundai is catching up with Tesla in the global EV race (FT)Sony PlayStation faces UK class action lawsuit of up to £5bn (FT)CATL aims for ‘battery as a service’ hegemony in China (Nikkei Asia)TikTok’s extraordinary rise signals a more multipolar internet (FT)India’s Ola plans massive EV push but obstacles await (Nikkei Asia)Tencent hurt by slowing Chinese economy and stalled game approvals (FT)Tighter monetary conditions rein in Asian unicorns (Nikkei Asia)#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp

Hello, this is Kenji from Hong Kong, where we are in the midst of the mid-year earnings season. The overall tone so far seems to be tilting toward the negative side, and the tech sector is no exception. While JD.com pleasantly surprised the market with its results, both Tencent Holdings and Alibaba Group Holding reported zero top line growth for the first time since their listings over a decade ago. Smartphone maker Xiaomi saw its net profit for the first half of the year dip 95 per cent, while component makers such as Sunny Optical and AAC saw their bottom lines cut by half or more.

The weak results are a function of various factors, primarily Covid-19 lockdowns, rising input costs, a tight regulatory regime for the tech sector and heightened geopolitical tensions — all which have combined to decelerate the Chinese economy as a whole.

And now, a new downward push is coming from the inland province of Sichuan, perhaps more familiar in its traditional spelling of “Szechwan,” from its connection with the local spicy cuisine. A severe power shortage in the area is forcing factories to shut down, snarling supply chains for everything from automobiles to Apple products. It is not clear how long the situation will drag on, but it has already brought another aspect of supply chain vulnerability to light.

Crunch time

The latest woe to hit China’s supply chain comes from the sizzling sunshine in the southwestern landlocked province of Sichuan and its neighbour Chongqing. In a series of reports, Nikkei’s Shunsuke Tabeta reveals how the historic drought has dried up the hydro-dams and derailed production of Tesla, Toyota Motor, Foxconn and more.

With rainfall dropping to half its normal level and temperatures regularly rising above 40C, hydroelectric power output — which accounts for nearly 80 per cent of the province’s generating capacity — has been drastically curtailed. The local government originally ordered industrial companies to halt production for the week through August 20, but that was extended multiple times, until Sunday for Sichuan and indefinitely for Chongqing. A total of 16,000 companies had to comply with the production suspension, hitting supply chains for a range of sectors.

The power supply squeeze in Sichuan also forced Shanghai’s historic riverfront Bund district to switch off its night-time lights for two days this week. The city’s earlier request to the province to prioritise resumption of suppliers providing parts for Tesla and SAIC Motor drew a backlash from ordinary people whose lives are also being affected by the shortages.

SoftBank explains itself

SoftBank Group has sold a large part of its stake in Alibaba to reassure investors that its finances were solid after logging a record quarterly loss of $23bn, Kana Inagaki and Leo Lewis write for the Financial Times.

In an exclusive interview, Yoshimitsu Goto, its chief financial officer, dismissed market concerns that continued heavy losses at the technology conglomerate could strain its relationship with lenders.

“In times like this, it is critical as an investment group to instantly show that our financial strength is rock solid,” Goto said.

According to Goto, the move was designed to mirror the previous sale of some of SoftBank’s most prized holdings that began when the Covid-19 pandemic led to a crash in its share price in March 2020.

Although the sale helped to shore up the company’s balance sheet, the decision to sharply reduce the Alibaba stake also comes with the political risk of being seen to abandon a Chinese investment at a sensitive time. China is in the throes of a regulatory crackdown on tech companies and diplomatic relations between Beijing and Tokyo are strained.

Wingtech takes flight

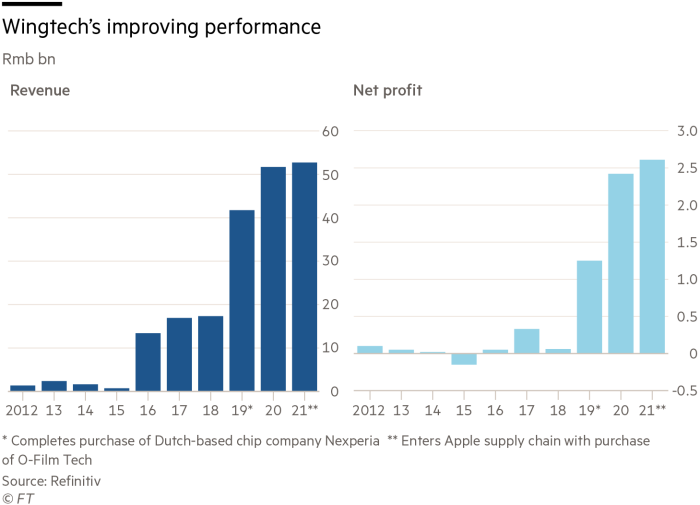

Wingtech Technology has been an Apple supplier for less than a year. But to many industry insiders, its rise has been surprisingly fast, according to a report by Shunsuke Tabeta and Nikkei Asia’s Cheng Ting-Fang and Lauly Li. Revenue and profit growth are a testament to the success of its ambitions to far.

The Chinese smartphone assembler already makes the Mac Mini desktop computer, and has recently won orders to build an older generation of MacBooks. Apple’s laptops are considered the most advanced consumer notebooks available, and their production has long been dominated by top Taiwanese contractors Quanta Computer and Foxconn. The Shanghai-listed challenger is now planning to hire at least 20,000 additional workers for its factory in Yunnan Province, the base from which it aims to capture more of the Apple and Samsung supply chain.

Robotic rumble

The race for hegemony in robotics is heating up as players from China, South Korea and Japan scramble for a slice of one of the most promising tech markets.

At the World Robot Conference 2022 held in Beijing, Nikkei Asia’s CK Tan got an up-close look at the 130 Chinese and foreign exhibitors showing off their latest wares, from drones to humanoid bots. Homegrown robot makers, he found, are increasingly eyeing the service and healthcare sectors as technology levels and labour costs both rise.

These are precisely the areas that rivals are looking at. In South Korea, the use of robots in the logistics and restaurant industries is already expanding to cope with serious labour shortages and a rising minimum wage. Japanese player Medicaroid, meanwhile, is preparing to venture beyond its home market to sell its surgical robots elsewhere in Asia.

Suggested reads

-

Chipmakers caught in crossfire of rising US-China geopolitical tensions (FT)

-

The mystery of SoftBank’s zero tax bill (Nikkei Asia)

-

Fujitsu, Riken to offer 1st Japan-made quantum computer (Nikkei Asia)

-

Hyundai is catching up with Tesla in the global EV race (FT)

-

Sony PlayStation faces UK class action lawsuit of up to £5bn (FT)

-

CATL aims for ‘battery as a service’ hegemony in China (Nikkei Asia)

-

TikTok’s extraordinary rise signals a more multipolar internet (FT)

-

India’s Ola plans massive EV push but obstacles await (Nikkei Asia)

-

Tencent hurt by slowing Chinese economy and stalled game approvals (FT)

-

Tighter monetary conditions rein in Asian unicorns (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp