Soros fund tightens grip over US radio waves after seizing control of bankrupt Audacy

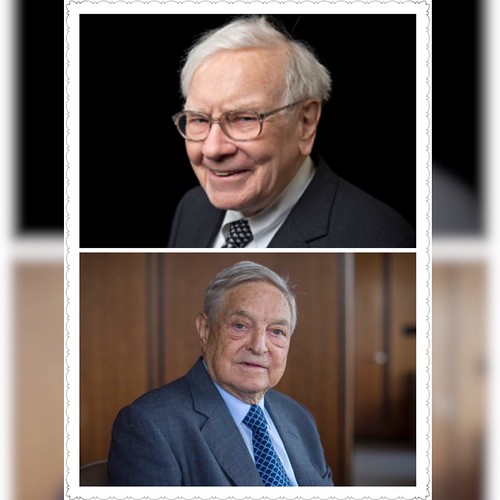

Soros Fund Management, founded by billionaire investor George Soros, is tightening its grip over the US radio industry after scooping up a majority stake in bankrupt radio company Audacy.

The fund’s February investment in Audacy — the second-largest radio firm in the US behind iHeartMedia — potentially marks the beginning of a larger audio-buying spree, three people who have been involved in discussions with Soros executives told Semafor.

In those talks, Soros’ fund, which is now controlled by the magnate’s nonprofit organization, Open Society Foundations, has privately mulled acquiring other major radio companies, including AM and FM giant Cumulus Media, according to Semafor.

As the largest shareholder in Audacy, Soros Fund Management already owns 230 radio stations nationwide — including New Yorks WFAN and 1010 WINS, as well as Los Angeles-based KROQ, per bankruptcy filings — as well as a podcast arm that includes Cadence13 and Pineapple Street Studios.

The fund also took on roughly $400 million of Audacy’s sizable debt in its corporate maneuver.

The fund’s lead media investor, Michael Del Nin, has arranged meetings with multiple heavyweight players in the digital media and audio space over the past year, including at podcasting firm Project Brazen, per Semafor.

Del Nin has also mulled an acquisition of Pushkin Industries — the podcasting and audiobook company co-founded by Malcolm Gladwell — as well as podcast network Lemonada Media, best known for its “Wiser Than Me” show with Julia Louis-Dreyfus, sources told Semafor.

Separately, a podcast industry insider told the outlet that Lemonada, which also inked a podcasting deal with Meghan Markle in February — is in the middle of a formal process to find a buyer, but potential clients have refused to pay the company’s high asking price.

However, the Federal Communications Commission has regulations that limit the number of radio stations a single entity can own.

In addition, in September 2022, Soros also invested an undisclosed amount in liberal podcast network Crooked Media, Semafor reported, which is home to the popular “Pod Save America,” which averages upwards of 1.5 million listeners per episode.

That same year, a Soros-backed firm played a key role in Univision’s $60 million sale of 17 Hispanic radio stations to a company run by veterans of Democratic politics, per Semafor.

Subscribe to our daily Business Report newsletter!

Please provide a valid email address.

By clicking above you agree to the Terms of Use and Privacy Policy.

Never miss a story.

Republican representatives at the time warned that Soros was trying to take over Cuban radio, according to the Miami Herald, with one right-leaning media startup warning in a text blast that “the international socialist billionaire” was “trying to silence conservative Spanish voices with the purchase of” WAQI-710 AM Mambi.

When Soros’ Audacy investment was announced just months later, a Republican insider close to the situation told The Post at the time that it was possible Soros was buying the stake to exert influence on public opinion in the months leading up to the 2024 presidential election.

This is scary, the source said.

Audacy filed for bankruptcy on Jan. 7 with $1.9 billion of debt.

Under its current Chapter 11 bankruptcy plan, existing shareholders are expected to be wiped out, and high-ranking creditors like Soros would be repaid with stock in the restructured company.

Representatives for Soros Fund Management at Open Society Foundations did not immediately respond to The Post’s request for comment.

The reins of Open Society Foundations — which funnels about $1.5 billion a year to liberal causes — were recently handed to Soros’ youngest son, Alex, a 38-year-old NYU grad who said he was picked partially because he is even more political than his elderly dad.

In yet another media play for Soros, a fund linked to Soros joined a consortium last summer of former lenders who paid $350 million for bankrupt Vice Media — an outlet that at its peak was once valued at $6 billion.

A judge in Manhattan federal bankruptcy court ruled that Soros Fund Management and Fortress Investment Group represented the best option to take the Brooklyn-based media firm out of Chapter 11 bankruptcy.

The fire sale marked the stunning demise of Vice, which was co-founded by larger-than-life media exec Shane Smith.