Toyota says there’s no EV demand – maybe try selling one the wheels stay on?

Toyota is at it again, claiming that there’s not enough demand in the United States for electric vehicles – most of which are currently suffering from months of backlog in the United States due to high demand. Even their own bZ4X has a waiting list because, well, the wheels keep falling off.

The comments came from Jack Hollis, Executive Vice President of Sales at Toyota Motor North America in a webinar hosted by the Automotive Press Association.

Hollis was speaking about the US government’s plan to encourage 50% EV sales by 2030, a target that still falls short of what’s necessary to avoid the worst effects of climate change and is significantly less ambitious than the California plan to end gas vehicle sales by 2035 (and reduce them by 68% by 2030), which could also probably be stronger.

But, according to a new poll, US voters go even further, supporting a 2030 end to gas car sales nationwide, a stronger proposal than both the current US plan and even the California plan.

And the most popular EV company in the United States – which sells twice as many EVs as all other automakers combined – already sells no gas-powered vehicles in 2022. And, despite continuously increasing production levels for more than a decade, it still hasn’t found a ceiling for demand. In fact, the company is currently sold out for months even after continual recent price hikes.

Despite all of this, Hollis, whose company currently sells no BEVs in the United States, thinks he knows better than governments, the public, and companies that actually produce EVs.

Hollis claimed:

I don’t think the market is ready. I don’t think the infrastructure is ready. And even if you were ready to purchase one, and if you could afford it … (the price is) still too high … It took 25 years to get to less than 10% (market share) for hybrid … The consumer isn’t demanding (EVs) at that level. The consumer is not screaming, ‘30% or 40% by tomorrow.’

To break this down point by point:

Is the market ready? It seems to be, given that no EV maker can currently meet demand.

Is the infrastructure ready? A DoE study said there is more than enough spare overnight capacity to power EVs, and flexibility in EV charging times or the potential of V2G can help increase grid resiliency.

Can you afford it? The 2023 Chevy Bolt starts at $25,600 and will have access to the renewed $7,500 EV tax credit and additional state and local credits. There are other low-price EVs available, and the Inflation Reduction Act even includes a $4,000 credit for low-priced used EVs. However, going back to the demand point – prices are high on used EVs right now because demand is so high for EVs.

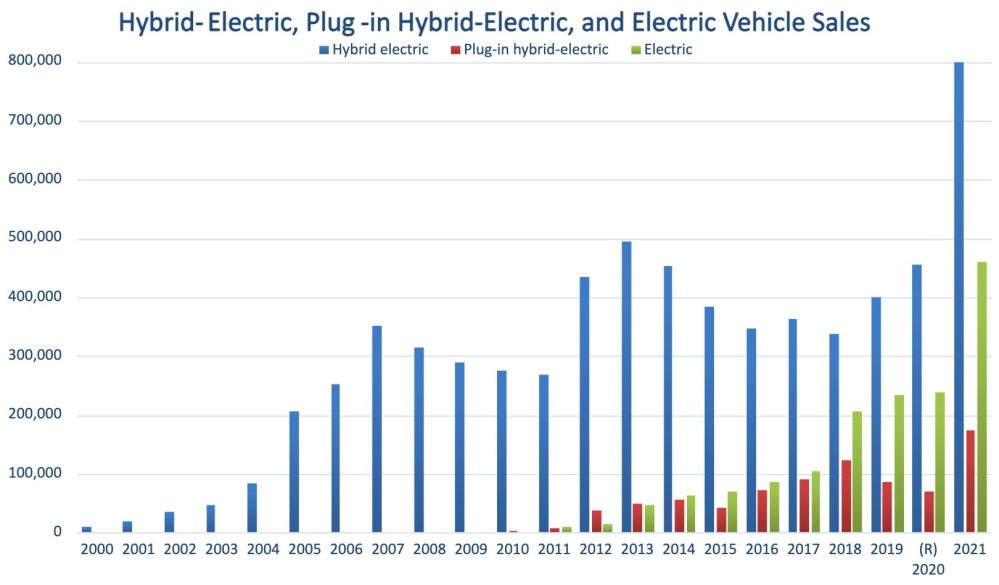

But it took 25 years to get to 10% for hybrids! These are EVs, not hybrids – hybrids are a compromise technology, not an end-goal. They offer little change in how people use vehicles since they’re still fueled 100% by gasoline (though they are more efficient, and there are benefits for widespread adoption). Also, we’re already past 10% for EVs in California, and nationwide EV market share is about 5% in the first half of 2022, up from 2.5% last year. Extrapolate that to find out how hard it will be to get to 10%.

The consumer doesn’t want “30% to 40% by tomorrow.” Per the poll cited above, a majority of US consumers do in fact want stronger regulations than those proposed by the government. And in the most forward-looking country, Norway, consumers have exceeded even the world’s earliest government goals.

This is not the first time Toyota has shown ignorance and opposition to the EV market. Executives at various levels in the company have made similar public statements in the past, up to and including Akio Toyoda, the CEO. The company routinely greenwashes and spreads scientifically illiterate anti-EV propaganda, while lobbying against human life and indoctrinating kids against EVs.

While the company has started to tentatively acknowledge the necessity of moving toward EV sales and investing in production capacity, we still see public statements like Hollis’s. There is a lot of internal resistance within the company, and even if Toyota did want to turn the ship, it would have to deal with a lot of “old-school” thinking among its executives, as displayed in Hollis’s comments.

But Toyota’s continued stance on EVs may be colored by its experience. Its first battery-electric vehicle program is currently on an indefinite stop sale and recall after only a few hundred sales because the wheels were falling off. Maybe if they tried selling an EV the wheels didn’t fall off of, they’d see a little more demand.

Electrek’s Take

As we’ve seen in the EV market, while serious EVs do well, half-baked models don’t. Consumers do want EVs, but if a company doesn’t take its effort seriously, consumers will just turn to another company that does. EV buyers just aren’t interested in first-generation EVs in 2022, a decade after the Tesla Model S (arguably a second-generation EV), hit the road.

Hollis’ comments on hybrids also showcase Toyota’s sour grapes that it can no longer rest on its hybrid laurels. It pushed hybrid as the technology of the future and refused to move on EVs. But instead of picking up the pace and trying to catch up in innovation when it became apparent they are behind, it is still trying to convince the world that it was right.

This intransigence can only lead to Toyota’s decline, and it needs to shape up or it won’t just hurt itself, but the entire Japanese economy.

As Hollis says – in 25 years, hybrids only reached 10% and seemed to have plateaued until last year, so clearly consumers just aren’t interested. Maybe that will happen with EVs, but I’d place a bet that it won’t.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Toyota is at it again, claiming that there’s not enough demand in the United States for electric vehicles – most of which are currently suffering from months of backlog in the United States due to high demand. Even their own bZ4X has a waiting list because, well, the wheels keep falling off.

The comments came from Jack Hollis, Executive Vice President of Sales at Toyota Motor North America in a webinar hosted by the Automotive Press Association.

Hollis was speaking about the US government’s plan to encourage 50% EV sales by 2030, a target that still falls short of what’s necessary to avoid the worst effects of climate change and is significantly less ambitious than the California plan to end gas vehicle sales by 2035 (and reduce them by 68% by 2030), which could also probably be stronger.

But, according to a new poll, US voters go even further, supporting a 2030 end to gas car sales nationwide, a stronger proposal than both the current US plan and even the California plan.

And the most popular EV company in the United States – which sells twice as many EVs as all other automakers combined – already sells no gas-powered vehicles in 2022. And, despite continuously increasing production levels for more than a decade, it still hasn’t found a ceiling for demand. In fact, the company is currently sold out for months even after continual recent price hikes.

Despite all of this, Hollis, whose company currently sells no BEVs in the United States, thinks he knows better than governments, the public, and companies that actually produce EVs.

Hollis claimed:

I don’t think the market is ready. I don’t think the infrastructure is ready. And even if you were ready to purchase one, and if you could afford it … (the price is) still too high … It took 25 years to get to less than 10% (market share) for hybrid … The consumer isn’t demanding (EVs) at that level. The consumer is not screaming, ‘30% or 40% by tomorrow.’

To break this down point by point:

- Is the market ready? It seems to be, given that no EV maker can currently meet demand.

- Is the infrastructure ready? A DoE study said there is more than enough spare overnight capacity to power EVs, and flexibility in EV charging times or the potential of V2G can help increase grid resiliency.

- Can you afford it? The 2023 Chevy Bolt starts at $25,600 and will have access to the renewed $7,500 EV tax credit and additional state and local credits. There are other low-price EVs available, and the Inflation Reduction Act even includes a $4,000 credit for low-priced used EVs. However, going back to the demand point – prices are high on used EVs right now because demand is so high for EVs.

- But it took 25 years to get to 10% for hybrids! These are EVs, not hybrids – hybrids are a compromise technology, not an end-goal. They offer little change in how people use vehicles since they’re still fueled 100% by gasoline (though they are more efficient, and there are benefits for widespread adoption). Also, we’re already past 10% for EVs in California, and nationwide EV market share is about 5% in the first half of 2022, up from 2.5% last year. Extrapolate that to find out how hard it will be to get to 10%.

- The consumer doesn’t want “30% to 40% by tomorrow.” Per the poll cited above, a majority of US consumers do in fact want stronger regulations than those proposed by the government. And in the most forward-looking country, Norway, consumers have exceeded even the world’s earliest government goals.

This is not the first time Toyota has shown ignorance and opposition to the EV market. Executives at various levels in the company have made similar public statements in the past, up to and including Akio Toyoda, the CEO. The company routinely greenwashes and spreads scientifically illiterate anti-EV propaganda, while lobbying against human life and indoctrinating kids against EVs.

While the company has started to tentatively acknowledge the necessity of moving toward EV sales and investing in production capacity, we still see public statements like Hollis’s. There is a lot of internal resistance within the company, and even if Toyota did want to turn the ship, it would have to deal with a lot of “old-school” thinking among its executives, as displayed in Hollis’s comments.

But Toyota’s continued stance on EVs may be colored by its experience. Its first battery-electric vehicle program is currently on an indefinite stop sale and recall after only a few hundred sales because the wheels were falling off. Maybe if they tried selling an EV the wheels didn’t fall off of, they’d see a little more demand.

Electrek’s Take

As we’ve seen in the EV market, while serious EVs do well, half-baked models don’t. Consumers do want EVs, but if a company doesn’t take its effort seriously, consumers will just turn to another company that does. EV buyers just aren’t interested in first-generation EVs in 2022, a decade after the Tesla Model S (arguably a second-generation EV), hit the road.

Hollis’ comments on hybrids also showcase Toyota’s sour grapes that it can no longer rest on its hybrid laurels. It pushed hybrid as the technology of the future and refused to move on EVs. But instead of picking up the pace and trying to catch up in innovation when it became apparent they are behind, it is still trying to convince the world that it was right.

This intransigence can only lead to Toyota’s decline, and it needs to shape up or it won’t just hurt itself, but the entire Japanese economy.

As Hollis says – in 25 years, hybrids only reached 10% and seemed to have plateaued until last year, so clearly consumers just aren’t interested. Maybe that will happen with EVs, but I’d place a bet that it won’t.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.